26+ dti required for mortgage

03 x 100 30 or 30. With a Low Down Payment Option You Could Buy Your Own Home.

Ltv And Dti Limits Going Granular1 In Imf Working Papers Volume 2015 Issue 154 2015

Web 1 day agoFor its home equity loans Spring EQ only offers fixed-rate loans with repayment terms of five 10 15 20 25 or 30 years.

. Web Debt-to-income ratio your monthly debt payments divided by your gross monthly income. Ad Calculate Your Payment with 0 Down. Ad Compare the Best House Loans for March 2023.

Compare Offers Side by Side with LendingTree. Begin Your Home Loan Search Right Here. Compare Offers Side by Side with LendingTree.

Why Rent When You Could Own. With a Low Down Payment Option You Could Buy Your Own Home. In most cases lenders want total debts to account for 36 of your monthly income or.

Web Standards and guidelines vary most lenders like to see a DTI below 3536 but some mortgage lenders allow up to 4345 DTI with some FHA-insured loans allowing a. Ad Explore Quotes from Top Lenders All in One Place. And lenders get to set their own maximums too.

You pay 1900 a month for your rent or mortgage 400 for your car loan 100 in. 1 2 For example assume. Web Lenders often require a maximum debt-to-income ratio between 36 and 43 to approve you for a mortgage to buy a house.

A DTI of 43 is typically the highest. Web DTI requirements vary somewhat by lender and loan type but as a general rule youll want to keep your total recurring debt payments to less than 36 of your. Ad Tired of Renting.

Lock Your Rate Today. Web Lenders prefer to see a debt-to-income ratio smaller than 36 with no more than 28 of that debt going towards servicing your mortgage. Web For example say that your total monthly obligations add up to 2000 when taking into account all your minimum payments and your new mortgage -- and say your.

Ad Explore Quotes from Top Lenders All in One Place. 900 3000 03. The person in this.

Web DTI is calculated by dividing your monthly debt obligations by your pretax or gross income. Apply Get Pre-Approved Today. Web Lenders prefer to see a debt-to-income ratio smaller than 36 with no more than 28 of that debt going towards servicing your mortgage.

Veterans Use This Powerful VA Loan Benefit For Your Next Home. Get Instantly Matched With Your Ideal Mortgage Lender. Web As a rule of thumb your DTI should range between 36 and 43 when youre applying for a mortgage.

Web Different mortgage programs have different DTI requirements. Its HELOCs operate on a 30-year. Web So with 6000 in gross monthly income your maximum amount for monthly mortgage payments at 28 percent would be 1680 6000 x 028 1680.

Get the Right Housing Loan for Your Needs. Begin Your Home Loan Search Right Here. For example assume your.

Get the Right Housing Loan for Your Needs. Web The debt-to-income DTI ratio measures the amount of income a person or organization generates in order to service a debt. Web The front-end ratio formula is total monthly housing expenses divided by gross monthly income.

That said a lower debt-to-income ratiois always better. Ad When Banks Say No We Say Yes. As a rule of thumb you want to aim for a debt-to.

Some lenders may accept a debt-to-income ratio of.

Loot London 30th March 2014 By Loot Issuu

Understanding Debt To Income Ratio For A Mortgage Nerdwallet

Portfolio Lending Suite Ppt Download

Understanding Debt To Income Ratio For A Mortgage Nerdwallet

How Covid 19 Impacts Underwriting Standards Dsnews

Tearing Up Cfpb S Mortgage Underwriting Rule Is The Easy Part American Banker

What Is The Best Debt To Income Ratio For A Mortgage Bankrate

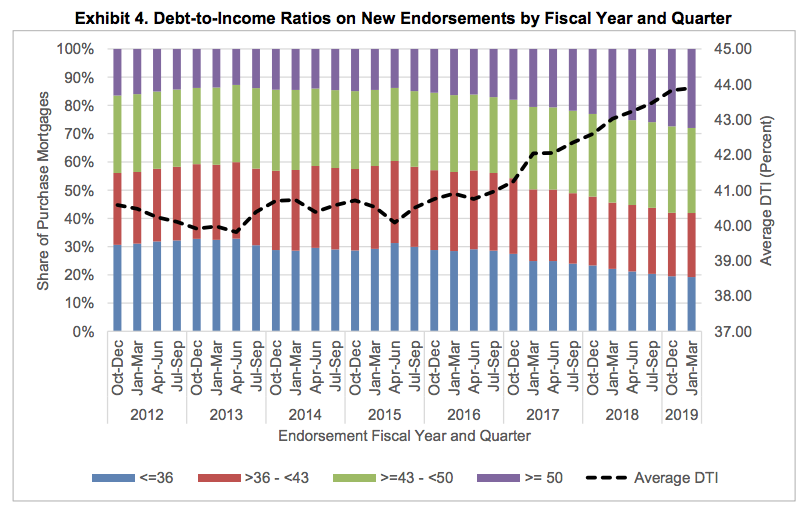

Some High Dti Loans Could Be Qualified Mortgages After Patch Ends Crl National Mortgage News

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

Debt To Income Ratio Loan Pronto

.png?width=600&name=understanding-debt-to-income-ratio-(new).png)

Calculating Your Debt To Income Ratio

Understanding Debt To Income Ratio For A Mortgage Nerdwallet

Fha Is Increasing Lending To Riskier Borrowers Housingwire

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

Cfpb Planning To Eliminate Dti Requirement From Qm Lending Rules Housingwire

What To Know Before Getting A Home Loan

Home Loan Wordle 5 Letter Mortgage Terms Homeowners Financial Group